Below are some infographics about universal credit and the impact it has on the UK as a whole:

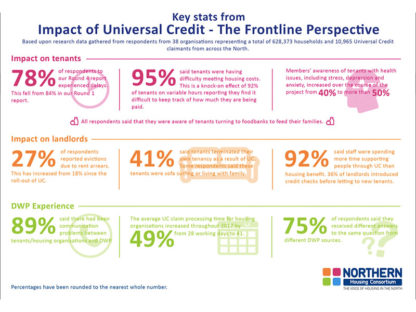

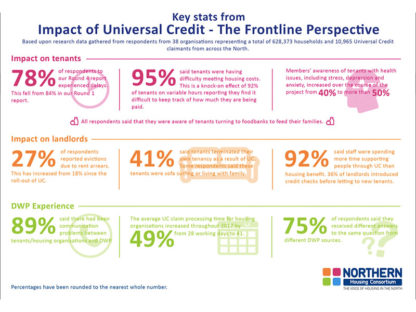

An infographic from 2015 of key statistics from the impact of Universal Credit – the frontline perspective, provided by the Northen Housing Consortium:

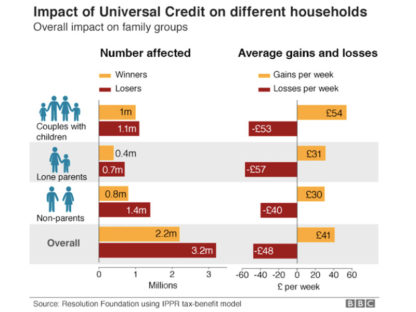

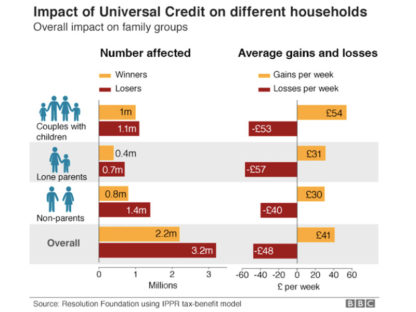

An infographic from 2018 of the impact of Universal Credit on different households with an overall impact on families by the BBC:

Below are some organisations that you can turn to for help and advice:

Understanding Universal Credit

Understanding Universal Credit is a website that is a part of gov.uk that provides further information, help and advice.

Turn2us

Turn2us is a charity that helps people living in poverty. It provides information and support about welfare benefits and charitable grants.

Money and pensions service

The Money and Pensions Service develops and co-ordinates a national strategy to improve people’s financial capabilities by providing free money guidance and debt advice.

What are the consequences and who can you turn to if your Universal Credit payment is wrong? People in the system speak out

Image provided by Unsplash

“I felt rubbish having to go to a food bank as it’s something I thought I’d never have to do. I felt useless and depressed,” reveals Rebecca Elkin, a single mum from Llanelli. This is something many other people in the same position say and feel, while relying on Universal Credit to get by.

After coming into force in 2013, the social security payment combining six different types of benefits for working-age people who have a low household income, has been under major scrutiny and criticism.

This follows the news that claimants could get £1,200 bonus money under a new government scheme.

Although Universal Credit has benefited many across Wales and the UK, many others are left feeling disenfranchised and are forced to resort to uncertain alternatives when their social security payments fail to materialise leaving them stressed, worried and fearing the unknown.

Listed below are some tips and advice from real people about what to do if you’re questioning your Universal Credit payment.

Appeal the Universal Credit decision

You have the right to appeal if you’re unhappy with a Universal Credit decision; whether your payment has been rejected, you’ve been given the wrong amount or have been sanctioned.

Yet the only way to do so is through an online form that has to be filled out in a month and for some, access to the internet isn’t practical.

Gillian Guy, chief executive of Citizens Advice, a network of charities that provide free, relevant information and advice, said: “Our evidence shows many people on Universal Credit are struggling to make ends meet, and that deductions are contributing to this.”

She said the government should introduce affordability tests when recouping debts from claimants.

Rebecca, 38, from Llanelli, experienced the downfalls of Universal Credit when she started using it in June. She was admitted to a treatment facility and didn’t have the access or facilities to pay her childcare bills.

Rebecca claims that 85% of her childcare payments were late.

“I didn’t have access to internet during treatment so I couldn’t upload my creche invoice as proof that Universal Credit were meant to be paying the fees,” Rebecca said.

“I had to use my own money that I didn’t have.”

Apply for a hardship payment

Sue Anderson, head of media at Step Change, a debt charity, says: “With almost 9.8 million people showing signs of financial distress, many households are at risk of reaching a tipping point into problem debt.”

Sue continued, “A knock to income triggered by events such as illness, unemployment or relationship breakdown makes people three times more likely to experience problem debt. It can happen to anyone.”

If you’ve been sanctioned – when you’ve failed to meet your responsibilities – you can apply for a hardship payment.

This is up to 60% of the amount you were sanctioned in the last month and reduces further Universal Credit payments as you have to pay it through that system.

“I felt rubbish having to go to a food bank as it’s something I thought I’d never have to do. I felt useless and depressed.”

Rebecca eventually had a refund when she left treatment and could physically explain her situation and prove she had a valid explanation.

She uploaded her previous months creche fees and Universal Credit ended up owing her £700 that she received after numerous phone calls.

Provide evidence through an online letter

Often, people are given the wrong payment which leaves many with no money. If you think this might be you, you can contact Universal Credit on their free helpline – 0800 328 5644, or give supporting evidence through an online letter here

Yet for some, this is still hard to do. Rebecca felt panic constantly that she was away and there was nothing she could do to fix her problem as she didn’t have access to a phone or internet.

She was worried that she wouldn’t have money to pay bills while she was in treatment and the stress that would put on her family.

Rebecca received help from the financial support department of The Wallich, a homeless charity, who give help and advice to homeless and vulnerable people – that spoke to Universal Credit for her, helped her sort a loan, food bank slips and forms and went to the Job Centre with her.

Use the Free helpline

If your payment is being reduced to pay off debt, you can contact Universal Credits free helpline to make sure you’re getting the correct amount of deductions but again, it’s not that simple for everybody.

Emily Hattersley aged 23, from Cardiff, lives with her boyfriend and daughter who is 20 months old. They started using Universal Credit in November 2018 which was a big help as Student Finance Wales didn’t have provisions for pregnant students.

Emily and her family are now in debt of up to £2k because her Universal Credit payments were incorrect and having to live off less money for a month resulted in Cwtch Care Charity, a care company, providing her daughter with some clothes and being given a voucher for a food bank.

“The truth is that out of £875 of our rent, £551 is paid by Universal Credit and every £1 my boyfriend and me make over that amount, 67p is taken from our Universal Credit,” Emily explains.

Even though they could be living in a cheaper location, Emily, who is now in full time employment, didn’t want to temporarily move her family as eventually they hope they won’t have to keep using the system.

Despite successful application, delays in Universal Credit will mean that those in the same position as Rebecca and Emily will likely be visiting a foodbank this Christmas.

Below are some infographics about universal credit and the impact it has on the UK as a whole:

An infographic from 2015 of key statistics from the impact of Universal Credit – the frontline perspective, provided by the Northen Housing Consortium:

An infographic from 2018 of the impact of Universal Credit on different households with an overall impact on families by the BBC:

Below are some organisations that you can turn to for help and advice:

Understanding Universal Credit

Understanding Universal Credit is a website that is a part of gov.uk that provides further information, help and advice.

Turn2us

Turn2us is a charity that helps people living in poverty. It provides information and support about welfare benefits and charitable grants.

Money and pensions service

The Money and Pensions Service develops and co-ordinates a national strategy to improve people’s financial capabilities by providing free money guidance and debt advice.