With China’s influences deepening in Africa, there are concerns as to the country’s real interests on the continent. Is China’s real interest in Africa exploitative and a new form of colonisation, or is it the necessary force needed to drive Africa’s development?

Over the last decade, China’s presence in Africa has expanded exponentially, with the country pouring out investments into Sub-Saharan and Northern Africa. From a mere value of 765 million U.S. dollars in 1978, China-Africa trade grew to a value of over 170 billion U.S. dollars in 2017, an increase of over 200 percent according to Brookings statistics. By the end of 2016. China’s investments in Africa had reached over 100 billion U.S. dollars, a 100-fold increase from the value in 2004. A report by Ernest and Young show that in 2016, China became the largest single contributor of Foreign Direct Investments in Africa having invested over 60 billion U.S dollars and created over 130,000 jobs from 2005 to 2016. In 2018. China’s President, Xi Jinping, further pledged a 60 billion U.S. dollars funding package for Africa.

This deepening economic presence of China on the continent has generated a lot of concern by some African analysts and Western observers who see this as a new form of colonization, given the continents history with European colonization.

“We want the Chinese to leave and the former colonial rulers to return. They exploited our natural resources too, but at least they took good care of us. They built schools, taught us their language and brought us the British civilization…at least Western capitalism has a human face; the Chinese are only out to exploit us.”

Michael Sata, Ex-Zambian president, in 2007, weary of the growing Chinese presence in the former British colony

He is not the only analyst with this shared sentiment. Hilary Clinton speaking to Reuterswarned African leaders to be careful of the Chinese growing presence. She stated that unlike countries like the United States that sought to improve political and economic governance, China was only interested in exploiting the natural resources at the expense of political stability. She said, “We don’t want to see a new colonialism in Africa. When people come to Africa to make investments, we want them to do well and also, we want them to do good. We don’t want them to undermine good governance in Africa.”

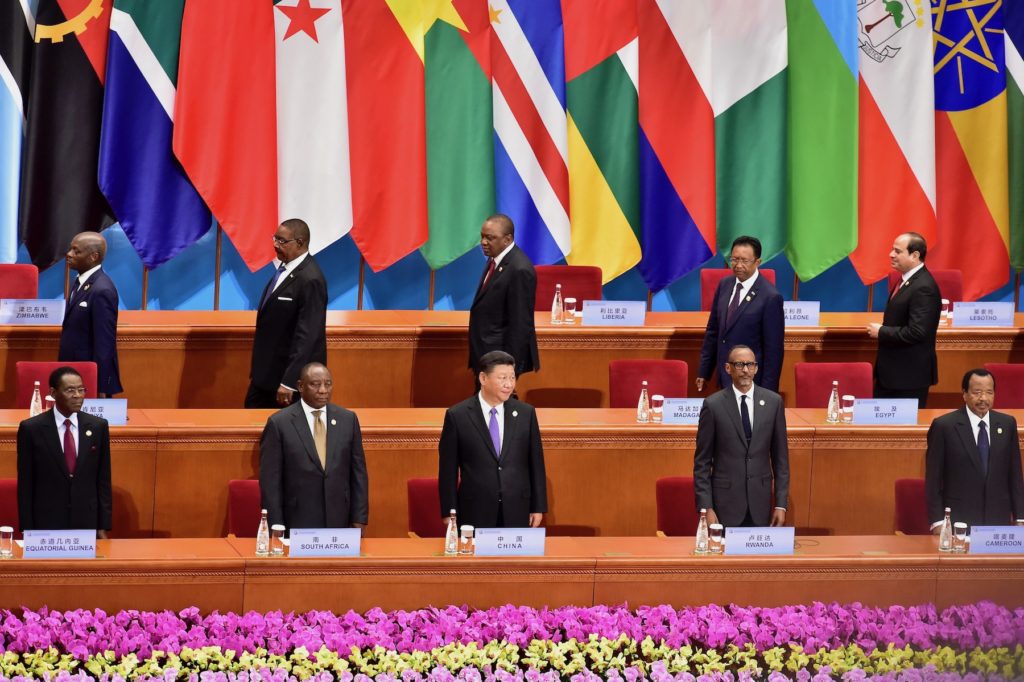

Against the talk of neo-colonialism and debt trap associated with Chinese loans, some African Presidents debunked these concerns and defended China’s growing relationship with Africa at the Forum on China-Africa Cooperation (FOCAC) in Beijing in 2018.

South-African President, Cyril Ramaphosa, commended China’s economic development and investments in Africa. He debunked claims of neo-colonialism saying that such claims were a ploy used by detractors. Speaking at the forum, he said, “In the values that it promotes, in the manner that it operates and in the impact that it has on African countries, FOCAC refutes the view that a new colonialism is taking hold in Africa, as our detractors would have us believe.”

President Paul Kagame of Rwanda, who is also the rotating chair of the African Union, refuted claims of neo-colonialism and debt trap diplomacy by China at the forum. He stated that China’s investments come at no expense to any parties and Africa’s relations with China was not a zero-sum game. He further stated that parties involved in business on the African continent, stood to gain from the China-Africa relations.

Chinese investments in Africa come with its downsides

There is no doubt that Chinese investments in Africa have helped fuel the construction and development of infrastructures across the continent. Brooking statisticsshow that 66 percent of China’s investments in Africa is concentrated in the energy and transport sectors with the remaining 34 percent shared among the finance, real estate, metals, technology, agriculture and other industries. These investments have been used to aid the constructions of railway lines, airports and clean energy sources such as hydropower.

In Addis Ababa, the capital of Ethiopia, the Export-Import Bank of China provided 85 percent of the 475 million U.S. dollars needed to fund the construction of the 34.25km Light Railwaywhich now caters to over four million residents. In Kenya, Chinese loans have been used to fund numerous infrastructures including the construction of a 290-mile railway linewhich is to run from the coasts of Kenya to Uganda. The construction of this railway line, which is set to become the longest railway line in Africa, was however halted when global concerns arose as to the sustainability of this debt by the country. The Kenya-Uganda railway line was to cost over 4.9 billion U.S. dollars.

Chinese loans are actively being collected by African countries to facilitate the construction and development of these infrastructures because of the lower interest rates they attract compared to loans from the United States and other European countries. They are also more readily available, making them addictive to African leaders. This however has given rise to concerns of the sustainability of these debts in the long run. InSub-Saharan Africa, China is the largest provider of bilateral loans. A report by the IMF shows that forty percent of low-income countriesin Sub-Saharan Africa are now at a high risk of debt distress.

Already in Zambia and Sri Lanka, infrastructures built and funded with Chinese loans have been repossessed by the Chinese government due to the failure of these countries to repay the debts. In Zambia, there have been reportsof talks between the Zambian and Chinese government to hand over the country’s electrical company, ZESCO, to the Chinese due to the inability of the Zambian government to meet up with its repayment promises. The Chinese already own the country’s state-owned TV and radio channel, ZNBC.

In an article published by a popular African news outlet, titled ‘Bonds, Bills and ever bigger debts’, it stated that the Chinese government sought to encourage indebtedness by African countries so as to take control of strategic national assets. It said. “A major worry of the IMF and US is that China’s BRI strategy is first to encourage indebtedness, and then to take over strategic national assets when debtors default on repayments. The state electricity company ZESCO is already in talks about a takeover by a Chinese company, AC has learned. The state-owned TV and radio news channel ZNBC is already Chinese-owned. The long-term outcome could be effective Chinese ownership of the commanding heights of the economy and potentially the biggest loss of national sovereignty since independence.”

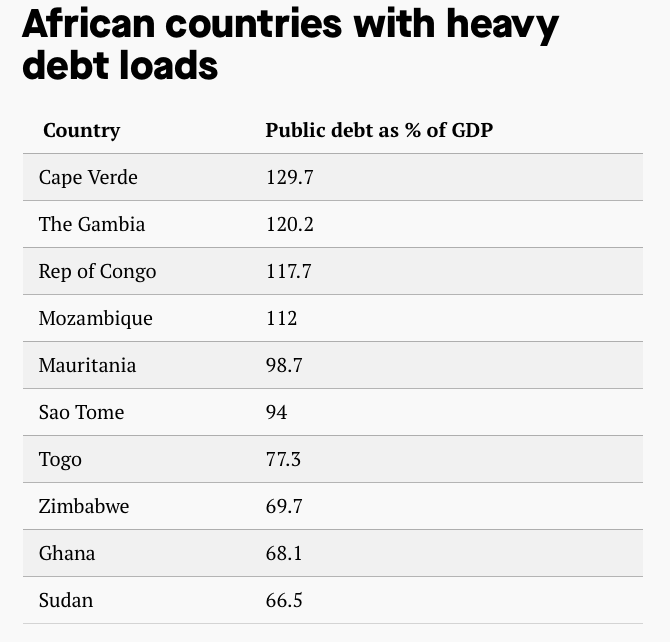

Brookings table based on information from the IMF’s World Economic Outlook, showing African countries with heavy debt loads

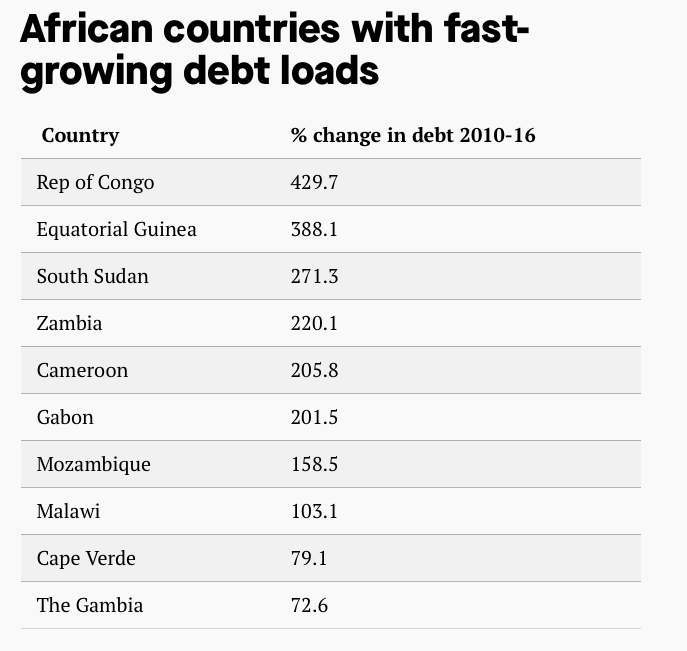

Brookings table based on information from the IMF’s World Economic Outlook, showing African countries with fast-growing debt loads

The IMF has issued warningsto African countries about the risks of mounting debts which have been aggravated by falling commodity prices in some countries or exorbitant spending in other countries.

IMF African Director, Abebe Selassie, at a Q & A event in New York organized last year by Quartz/ Invest Africa spoke about these concerns. “What we are pointing to is the need to push back against increase in debt. Borrowing to finance spending is part of the macroeconomic policy tool kits which all countries use,” Selassie said. “But over the medium to long-term they have to rely more on domestic revenues, tax revenues to address their development spending needs.”

He stated that for African countries to sustain this demand for investments for infrastructures, the continent, which has the lowest revenue-GDP ratio in the world, will have to become more self-reliant.

Chinese investments in Nigeria: welcome development or neo-colonialism?

Although Nigeria is not listed as one of the countries at high risk of debt distress by the IMF, it is one of China’s largest investmentpartners on the continent according to Brookings statistics. According to the Chinese investment tracker, Nigeria holds seventeen percent of China’s total investment on the continent. In 2015, when the Chinese President, Xi Jinping, pledged 60 billion U.S. dollars to aid the construction and development of infrastructure across the continent, five billion U.S. dollarswas allocated to Nigeria, a share of over eight percent of the total investments.

Chinese loans have been used to fund the construction of several infrastructures across Nigeria. In the transport sector, Chinese loans were used to fund the construction of the 187km Abuja-Kaduna railway line which was completed in 2014. The project cost a whopping 874 million U.S. dollars. Also, still in the process of construction, is a 312km railway line which is to run from Lagos to Ibadan. It is estimated to cost about 1.2 billion U.S. dollars. These are just a few examples of Chinese investments in the country.

These growing Chinese investments have raised concerns as to the country’s ability to sustain these debts and not end up having these infrastructures repossessed as in the cases of Zambia and Sri Lanka.

“Although China does not have a cultural stronghold in Nigeria like the United States, China is coming and it might eventually colonise Africa; but it is coming in through the route of economic imperialism if there is such a thing.”

Dr. Richard Ikiebe, former Special Adviser to the Minister of Information and Culture in Nigeria, speaking on Chinese growing investments

The President of Nigeria, Muhammadu Buhari, however dispelled these claims at the Forum on China-Africa Cooperation (FOCAC) in Beijing last year, stating that Nigeria had the capacity to repay these loans at the appropriate time. He said, “Some of the debts incurred are self-liquidating. Our country is able to repay these loans as and when due in keeping with our policy of fiscal prudence and sound housekeeping.”

This comment by the President however did nothing to alleviate the concerns of some Nigerians. Local businessmen and entrepreneurs have expressed concerns about China’s growing commercial presence in Nigeria. One of such entrepreneurs, Mr. Kennedy Oikerhe, speaking to the Punch said, “Every contract agreement China signs (especially in Africa) creates direct and indirect business opportunities for Chinese companies. It also provides employment for Chinese workers at all levels. This development puts us in a disadvantaged position because our unemployment rate index continues to increase.”

Dr. Ikiebe speaking on this said, “Every agreement starts on a paper on which is written the terms of the agreement. If the Nigerian government are stupid enough to sign away their future, Chinese people are smart enough to make sure that the loans will be paid for by their people. They will not only give money, but they will also give workers thus having the upper hand.”

With global observers and analysts raising red flags about China’s growing involvement in Africa, Dr. Ikiebe believes that China’s end game on the continent will be determined by the ability of African governments to negotiate better deals and contracts. He said, “China is not only in Africa, it is everywhere. For Africa to benefit positively from this relationship in the long term, African governments will have to do better in negotiating deals and contracts that takes into account, its citizens’ interests.”