Second Homes tax would influence young people buying homes in Tenby, which has a high proportion of second homes, but also affect the local development.

“Young people leave here is because the local people cannot afford the houses cause they push the houses’ price up,” said Sue Wharrad, who has been the volunteer in art gallery and museum in Tenby for four years after retired from retall manager.

“More and more people who has second homes in Pembrokeshire and Denbighshire, especially nice holiday places. So what the council do the second homes that people have they pay extra council tax,” added Sue.

People from away buy a house away and live there. But they buy a house here as well. And they just come down for holidays. They will pay tax to council for the holiday home. According to the Pembrokeshire County council, the definition of a second home is a dwelling which is not a person’s sole or main home and is substantially furnished. The Council has resolved to charge for a premium of 50% in addition to the standard rate of council tax for properties that fall within this definition.

“The young people here cannot afford to buy a house. This is because, for example, if you were in London, the price of house in London is ridiculous, but you can buy a house here, and you will use it for holidays, but also, you can rent out for people who come here for holidays as well, which is bad for the area. Because everybody wants to buy house for their holidays, the price go up and up, which is bad for the community,” said Sue earnestly.

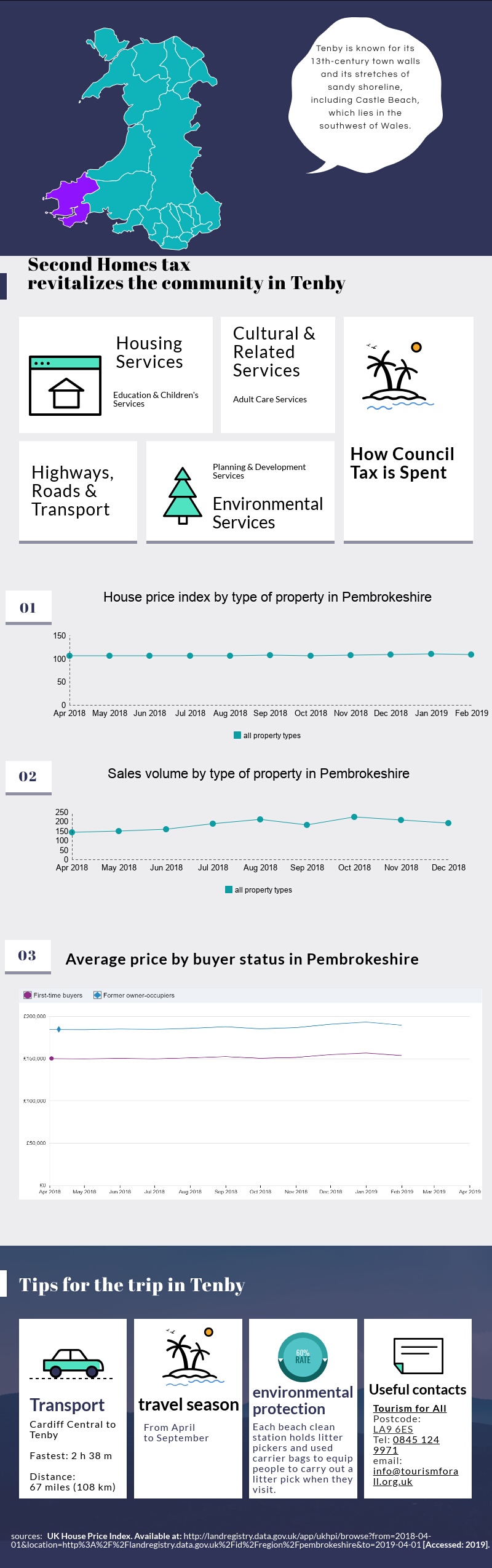

According to the latest figures from the Land Registry, a non-ministerial department of the Government of the United Kingdom, which is to register the ownership of land and property in England and Wales, showing that the average price of all property types of houses for Pembrokeshire, Cardiff and London are £170,585, £209,853 and £459,800 respectively.

“The situation in Tenby is dire with entire streets in darkness during winter months. As an example, in Lower Frog street which is within the Town walls there are 31 dwellings, 22 are second homes. Just outside the walls in Harding Street there are 11 dwellings, 8 are second homes,” said county councilor Michael Williams, the leader of the plaid cymru group, whose electoral division is Tenby north.

The Land Registry showed that the percentage change (yearly) by the former owner occupiers and first-time buyers in Pembrokeshire are from 3.8% to 4.1%, and from 4.1% to 3.8% respectively. Michael hope within the next two years to see second homes increase from 50% to 100%. The Pembrokeshire County council is now trying to amend the legislation to prevent second home owners from transferring these homes to business rates. This is being led by the Sian Gwenllian Plaid Cymru AM for Arfon.

“The youths move away, they cannot live here because there are not much work here either. Because it is a holiday place, it’s not industries or offices, you know, the big offices to employ lots of people,” explained Sue.

Sue who works in the art gallery and museum, has been working as a volunteer in the gallery since her retirement in Tenby. Sue sighed deeply as she looked out the gallery window at the beach on three sides. Because this beautiful beach also needs more people to be beach cleaners to maintain its original appearance.

“Although these empty buildings affect the ability of local organizations to recruit volunteers because so few people live in the city. The tax is in its second year and has generated approximately £1.9M in the County per year. It Tenby about approximately £90K a year which is available for local community projects,” said Michael.

Michael was the member, who first proposed this tax several years ago and finally managed to convince the majority in Pembrokeshire County Council that this would be an idea that could benefit communities that were struggling with the second homes blight.

According to the report from Business News Wales that Over the years, pembrokeshire beaches have won many International Blue Flag Awards, Green Coast Awards and Seaside Awards, and as a result, beautiful national parks, excellent beaches, charming coastal trails and charming countryside attract up to 4.2 million visitors a year at a cost of 544 million pounds. While Tenby, one of the famous harbour town located in pembrokeshire, which is known for tourism.

When you get off the train and go straight, in the colorful house shuttle for about 15 minutes, will see the beach. The beach is several times bluer than Cardiff bay, the purest unpolluted blue, where the sky and the sea intersected, layer upon layer. This is nature’s most beautiful blue.

“Therefore, an increasing number of people have second homes in pembrokeshire and Derbyshire for holidays, especially at resorts. And the more holiday homes in a town, the more money you get. So Tenby will get more money than that harvest west get because we got more holiday homes,” Sue added. “The art gallery and museum can also apply the money because we are the charity which depends on funding. If you apply to do something which will help the community, the council thinks it will benefit the community and then they would say yes,” explained Sue.

If people have the holiday home/ second home in Tenby, the local council charges the maximum council tax, which will be used in education and children’s services, adult care services, environmental services, planning and development services, housing services, cultural and related services, highways, roads and transport.

According to the Land Registry, from April 2018 to April 2019, the trend of the former owner occupiers and first-time buyers to purchase the housing prices are basically stable, while the former will pay 50,000 pounds more than the latter.

“And then the local council will give lots of money, such as they gave £ 90,000 to Tenby last year. And that will benefit the community and then different people in Tenby and organizations. Different people and organizations can apply and then the council will say yes or no to help areas, such as business men, charity or beach cleaners or somebody wants do something in the town to improve it,” said Sue.

This is because one of the local council’s plan for the tax is aim to support communities through grants, loans, and project management and market Pembrokeshire as a year round tourism destination through integrated marketing campaigns, and in partnership with Visit Wales and Visit Britain.

“The local charity or business write to the council and say can I have £ 10,000 to do that. They will say yes or no. It was really a new tax, carried out from last year but it’s really good. The money would also be distributed to benefit all of Pembrokeshire as well as communities with a large amount of affordable homes,” said Sue.